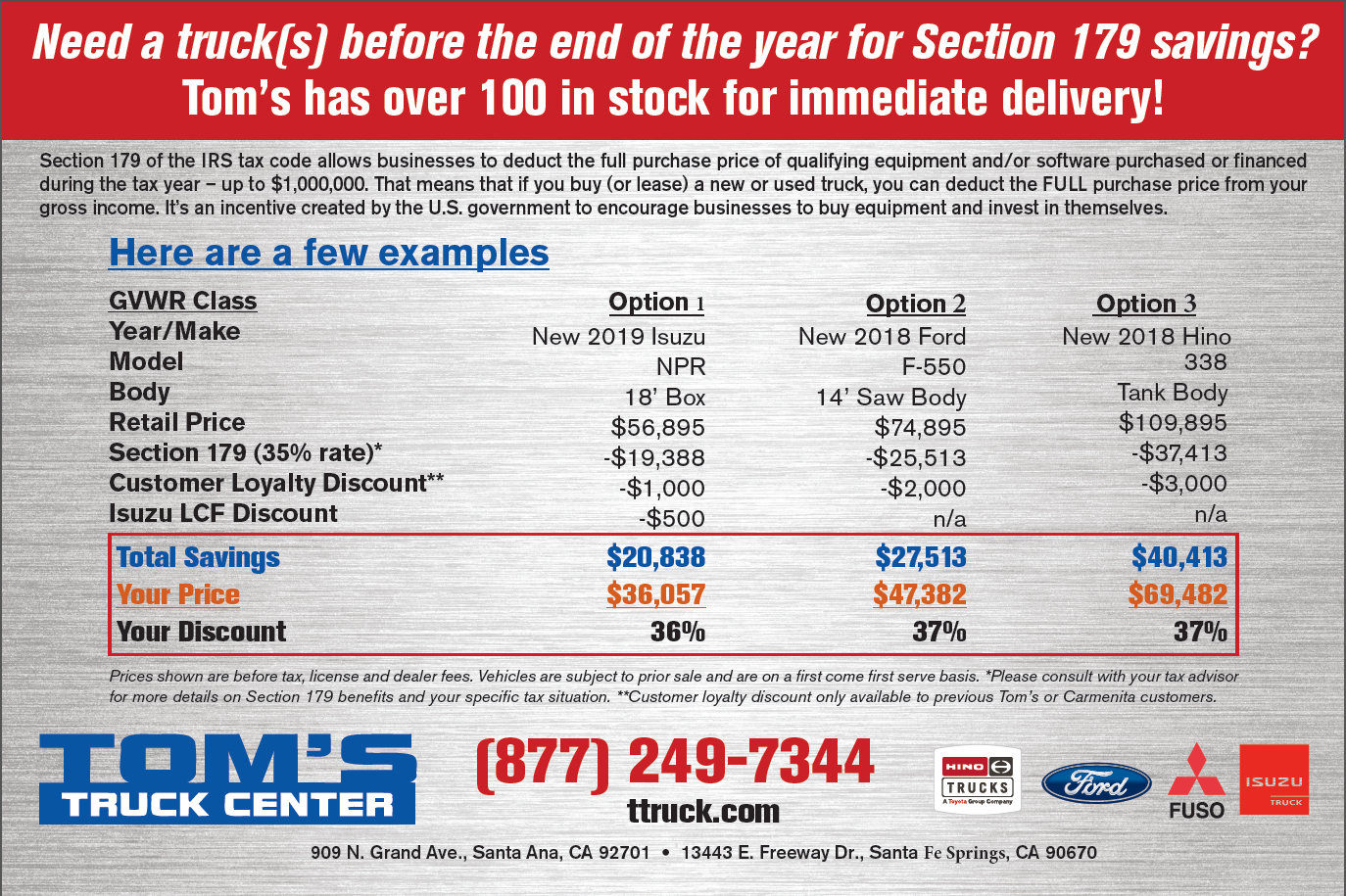

Visit for full details on the Section 179 Deduction. Here’s an easy to use calculatorthat will help you estimate your tax savings. The Section 179 Deduction has a real impact on your equipment costs. How much money can Section 179 save you in 2021? Also excluded from the deduction are land and improvements made directly to the land. Real property, such as buildings and their structural components, does not qualify. A recent change to the Section 179 Deduction, under the Tax Cuts and Jobs Act, has increased the amount of money that taxpayers are allowed to deduct (up to 1,080,000) on their 2022 income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated.

Examples of eligible property include trucks, machinery, and computers. The Bonus Depreciation is available for both new and used equipment. The Section 179 expense deduction is allowed only on depreciable, tangible, personal property. Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. Right now in 2021, it’s being offered at 100%. This spending cap makes Section 179 a true “small business tax incentive” (because larger businesses that spend more than $3,670,000 on equipment won’t get the deduction.)Īll businesses that purchase, finance, and/or lease new or used business equipment during tax year 2021 should qualify for the Section 179 Deduction (assuming they spend less than $3,670,000).īonus Depreciation is offered some years, and some years it isn’t. Under Section 179, business owners can deduct the entire cost of long-term personal property that they use in their business, rather than having to depreciate. The federal reduced dollar limitation for asset cost applies and is calculated using the New Jersey maxi- mum. This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. The maximum Section 179 deduction is 25,000. To take the deduction for tax year 2021, the equipment must be financed or purchased and put into service between Januand the end of the day on December 31, 2021.Ģ021 Spending Cap on equipment purchases = $2,620,000 This deduction is good on new and used equipment, as well as off-the-shelf software. Origin One P3 Material Safety Data SheetsĮxample of Section 179 at work during the 2021 tax year.

0 kommentar(er)

0 kommentar(er)